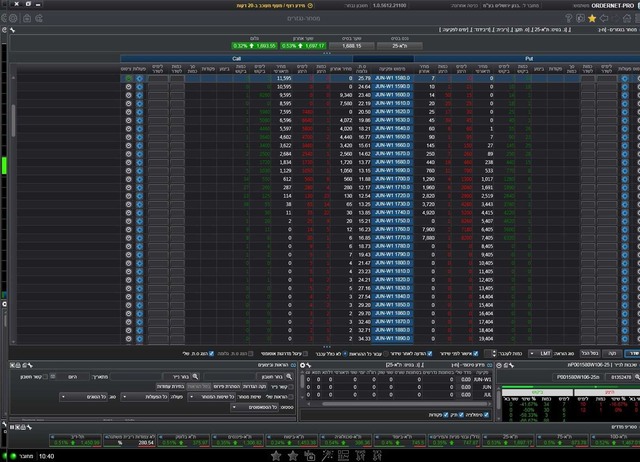

מסחר בבורסה מעניין אותך? קרא עוד בנושא

-

מידע למשקיע: מסים בשוק ההון

משקיעים בשוק ההון? כדאי להכיר את המסים שמוטלים על רווחי הון, ואת כל הדרכים לניהול נכון של מסים בכדי לשלם פחות.

קרא עוד -

גלה את הבורסה בלונדון

הבורסה לניירות ערך של לונדון ממוקמת בסיטי של לונדון והיא נחשבת לבורסה הגדולה ביותר באירופה ולרביעית בגודלה בעולם. הנה עוד כמה עובדות מעניינות עליה

קרא עוד -

סימני אזהרה שכל משקיע עצמאי צריך להכיר

ההחלטה להשקיע את הכסף בצורה עצמאית היא החלטה אמיצה, והיא מחייבת אותך להתמצא בג'ונגל הנקרא שוק ההון

קרא עוד